Blog

Mitigating China Supply Chain Issues in 2025

PUBLISHED ON:

March 10, 2025

Subscribe to Receive the Latest Supply Chain Design Resources

Jim Wilson

Senior Director Product Management

China has been the backbone of global manufacturing for years, but today, United States companies are rethinking their reliance on Chinese supply chains. Ongoing trade tensions, economic uncertainty, and geopolitical instability have made diversification a top priority this year. Many businesses are shifting toward manufacturing hubs like India, Mexico, and Vietnam to reduce risk and safeguard supply chain resilience. In fact, Census Bureau data confirms that Mexico remains America’s top trade partner for the third year in a row.

The US-China Business Council 2024 Member Survey highlights this shift. Only 80% of US companies with operations in China reported profitability in the past year, and 43% have adjusted their supplier or sourcing strategies in response to increasing challenges. Additionally, nearly a third of respondents are developing separate supply chains for China-specific, US-specific, or region-specific businesses to navigate trade restrictions and shifting market dynamics.

Government sanctions, export controls, and mounting geopolitical concerns are changing the future of trade between the US and China. Less than half of surveyed companies remain optimistic about China’s domestic market growth over the next five years, and 85% of respondents cited geopolitical tensions as the biggest factor impacting that outlook.

Despite these risks, China is still a key player in the global supply chain, dominating the technology and electronics industry. For now.

In this post, we’re demystifying the China supply chain issues–what they are, how they came to be, and what you can do to fortify your supply chains against these disruptions.

Key China Supply Chain Issues to Watch in 2025

One crucial element of a resilient supply chain is awareness. Understanding what risks are relevant to the supply chain in China this year will help you map out strategic, proactive responses that will keep your supply chain running as smoothly as possible all year long. Here are some of the biggest China supply chain issues to look out for in 2025:

1. Tariffs

On February 1st, 2025, the United States announced significant tariff increases on Chinese imports. The executive order imposed an additional 10% duty on a wide range of goods, including technology components, automotive parts, and raw materials set to take effect on February 4th. The administration later announced that the 10% universal tariff would be doubled starting March 4th. As of writing, this 20% additional duty has taken effect.

China originally retaliated by imposing tariffs ranging from 10% to 15% on U.S. imports, targeting key sectors such as natural gas, crude oil, raw materials, agricultural machinery, and automobiles. According to China’s State Council Tariff Commission, “The U.S.’s unilateral tariff increase seriously violates the rules of the World Trade Organization… It is not only unhelpful in solving its own problems, but also damages normal economic and trade cooperation between China and the U.S.” On March 4th, they responded to the second increase with additional tariffs of 10% to 15% on certain US imports starting March 10th, as well as a series of new export restrictions for designated US entities. They also raised complaints with the World Trade Organization. According to China’s foreign affairs ministry, “If war is what the U.S. wants, be it a tariff war, a trade war or any other type of war, we’re ready to fight till the end.”

Combined, these events mark an escalation in the trade war, which will continue to strain the economic relationship between the US and China. Production costs are increasing for US companies reliant on Chinese manufacturing, especially those in the technology sector. According to the Consumer Technology Association, these combined tariffs could raise laptop prices by 45%. New tariffs on American agricultural goods will impact $21 billion worth of US exports.

According to Stephen Dover, chief market strategist and head of the finance research firm Franklin Templeton Institute, China’s response seems calculated and measured. “A risk is that this is the beginning of a tit-for-tat trade war, which could result in lower GDP growth everywhere, higher U.S. inflation, a stronger dollar and upside pressure on U.S. interest rates,” Dover said.

While the Trump administration’s most recent tariffs target more than $450 billion in Chinese goods, China’s retaliatory tariffs target around $20 billion of the country’s annual US imports. It seems as though China’s retaliatory tariffs were meant to send a message while minimizing economic damage.

Further escalation is still possible. President Trump ordered a review of the US-China economic relationship when he took office. That review is due April 1, 2025. The results of this review could form the basis of a new tariff plan meant to address the trade imbalance between the US and China.

What Does This Mean for the Chinese Economy?

Despite meeting its growth target of 5% in 2024, China is still facing significant economic challenges. Consumer inflation rose to a five-month high in January 2025, while producer price deflation continued. Together, this indicates weak domestic demand. Manufacturing activity is also expected to contract for the second consecutive month in February 2025. To maintain its 5% growth target in 2025, China will rely on bold economic policies that stimulate domestic consumption.

US tariffs have prompted many Chinese companies to consider relocating production to Vietnam. HP, Inc. already addressed the impending tariffs by moving operations and increasing inventory levels. By the end of 2025, over 90% of HP’s products sold in North America will be built outside of China.

The evolving trade policies and economic conditions are prompting companies to reassess their supply chain strategies, considering factors like tariff impacts, production costs, and geopolitical stability. This dynamic environment requires continuous monitoring and adaptation to ensure resilience and competitiveness in the global market.

How Should Companies Respond?

The best way to reduce the negative impact of these tariffs on your China supply chain is diversification. Look into regional manufacturing, nearshoring, and sourcing from countries with more favorable trade agreements. Companies can also leverage trade programs like duty drawback and tariff engineering that shift classifications to lower-tariff categories using product modifications.

2. Extreme Weather Events

Climate change is hitting supply chains hard in 2025. The US already faced extensive destruction in 2024 due to Hurricane Helene and the L.A. wildfires. Damage from Hurricane Helene alone impacted more than 50 electronics, automotive, and aerospace manufacturers, as well as general machinery and materials processors and medical device and healthcare companies.

The impact is expected to intensify throughout the year as factory fires, extreme weather events, and labor disputes become more frequent and severe. Last year’s global temperatures were the highest they’ve been in recent history. Warmer oceans bring higher evaporation rates, higher atmospheric moisture levels, and an increased risk of powerful flood events, tropical storms, and convective storms.

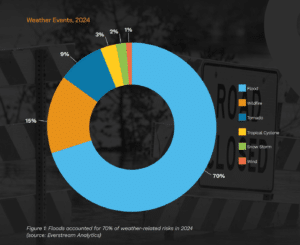

According to Everstream’s data, flooding events accounted for 70% of total weather disruptions worldwide in 2024. As ocean temperatures are expected to rise throughout 2025, supply chains should be prepared for frequent, disruptive flood events throughout the coming year.

On the bright side, heavy rainfall in the Panamanian Isthmus replenished Lake Gatun, allowing the Panama Canal Authority (ACP) to increase the maximum draft for transiting vessels to 49 feet and allow for up to 35 ships a day. The ACP’s board also recently approved funding for the construction of a new lake in the Indio River watershed, aiming to secure a reliable freshwater source for both the canal and Panama’s population.

Supply chains should also prepare for disruption due to wildfires, tornadoes, tropical cyclones, snow storms, and severe winds.

While climate-related disruptions are difficult to predict and avoid, there are ways to prepare. Companies should implement resilient infrastructure strategies by diversifying supplier locations and investing in climate-adaptive technologies like flood-resistant warehouses and fireproof storage. Developing predictive models for extreme weather events and keeping buffer inventory in low-risk regions can also help keep operations moving as smoothly as possible.

3. Geopolitical Instability

Due to escalating geopolitical instability, sourcing, manufacturing, and logistics will all be impacted by international conflict this year.

Taiwan

Escalating tensions between China and Taiwan will have profound implications for the global semiconductor supply chain. Taiwan Semiconductor Manufacturing Company (TSMC), the world’s largest contract chipmaker, holds approximately 62% of the global foundry market share. That number is projected to be 67% in 2025. Major tech companies like Apple and Nvidia rely on supply from TSMC.

The possibility of a Chinese invasion or increased military activity around Taiwan threatens disruption in Taiwan’s semiconductor output. Any conflict could result in the destruction of critical infrastructure, disruption in the Taiwan Strait, and cascading effects on global manufacturing and technology supply chains. In response to the threat, Taiwan is strengthening its ties with key allies like the United States via potential investments and collaborations.

China doesn’t have to deploy a full-scale invasion to cause disruption. Expansion of Chinese military exercises could disrupt transportation through major seaports and airports in northeastern China, western Taiwan, and Hong Kong with little forewarning. Disruption in the South China Sea could affect a third of global trade and 40% of all globally traded petroleum products. While an escalation isn’t currently on the horizon, China’s navy has become more aggressive and may try to limit shipping traffic.

Ukraine

The ongoing war in Ukraine led to sanctions against Russia by the US and Europe, reshaping global supply chains in the energy, agriculture, shipping, logistics, and global payment sectors. The conflict also prevented international carriers from utilizing Ukrainian and Russian airspace, forcing airlines to take longer and more expensive routes. As the war enters its third year, the United States recently abstained from a World Trade Organization declaration condemning Russian aggression marking a significant shift in stance.

Palestine

Israel’s conflict in Palestine continues to destabilize the Middle East, threatening global oil markets and maritime routes. The Red Sea will continue to be a hotspot for vessel attacks on cargo ships in 2025. If traffic along the Suez Canal were to return to full capacity this year, the shift would trigger processing delays, container backlogs, and congestion at many European seaports. However, the region will likely remain in a state of continued disruption due to infrastructure damage and worker shortages in areas affected by conflict.

Mitigation Strategies

To mitigate risks associated with geopolitical instability, companies should create contingency plans that involve alternative suppliers, redundant logistics routes, and strategic stockpiling of critical materials. Scenario planning can also be used to monitor political developments in high-risk regions to help businesses stay proactive.

4. BRICS Expansion

The expansion of BRICS could drastically shift trade dynamics for US-China supply chains in 2025. BRICS consists of eleven countries: Brazil, Russia, India, China, South Africa, Saudi Arabia, Egypt, United Arab Emirates, Ethiopia, Indonesia, and Iran. As of January 2025, Belarus, Bolivia, Kazakhstan, Cuba, Malaysia, Thailand, Uganda, Uzbekistan, and Nigeria joined the group as BRICS partner countries. More than 30 other countries expressed interest in participating in BRICS as members or partners in October 2024.

As BRICS grows, economic and political alliances between China and other BRICS nations could reduce the country’s reliance on Western markets. This expansion could foster an alternative global trade system that bypasses US-led financial institutions, which would further disrupt US-China trade flows.

For US companies, this could mean increased supply chain volatility and unpredictable risks related to tariffs, sanctions, and regional conflicts.

5. Cybercrime

As supply chains increase their reliance on cloud computing, artificial intelligence, and IoT-connected devices without updating security protocols and properly configuring firewalls, new vulnerabilities emerge. State-sponsored cyberattacks are targeting logistics and manufacturing systems, and ransomware threats and data breaches are exposing companies to intellectual property theft and operational disruptions. According to the World Economic Forum, global financial losses from cyberattacks will reach $10.5 trillion by 2025.

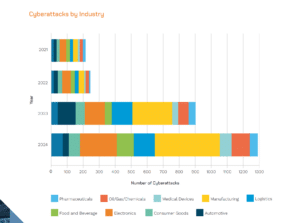

In 2024, these cybersecurity threats mostly targeted the electronics and manufacturing sectors. In the coming year, companies in logistics, manufacturing, and electronics should prioritize strengthening cybersecurity. Cyberattacks will likely use sub-tier supply chains to exploit common programming errors and vulnerabilities, then use sneaky methods like phishing and software connection links to reach top-tier companies. In an example reported by Everstream Analytics, Pennsylvania-based sub-tier pharmaceutical supplier Cencora had a security breach in the spring of 2024. That breach was linked to at least 11 subsequent cyber attacks targeting global pharmaceutical companies, including GlaxoSmithKline, Novartis, AbbVie, and Genentech.

To mitigate the risk of cyberattacks in 2025, companies should adopt zero-trust security models, strengthen their cybersecurity protocols, and ensure data redundancy. Sub-tier suppliers and connection links should also be closely monitored to keep attackers from infiltrating core supply chain networks.

6. Regulatory Crackdowns

Regulatory crackdowns are reshaping global supply chains, and there will be growing pains. As governments tighten laws on forced labor, data security, and environmental compliance, companies will have to prioritize compliance or risk facing penalties. In 2021, the US Department of Labor revealed 747 child labor violations with penalties totaling $3 million. In 2023, that jumped to 955 cases with penalties totaling $8 billion. Global efforts to combat forced labor, like the US Uyghur Forced Labor Prevention Act and the EU’s Corporate Sustainability Due Diligence Directive, for example, are compelling companies to evaluate their suppliers thoroughly to avoid potential penalties and customs delays.

Tightening data security laws in China and across the world are also making it harder for companies to collect, store, and transfer information. As for environmental regulations, pollution crackdowns have led to some factory closures that disrupt production and force companies to find alternative suppliers. China has committed to peak carbon emissions by 2030 and carbon neutrality by 2060. In pursuit of that goal, the Air Pollution Prevention and Control Action Plan and Water Ten Action Plan have led to increased fines, factory closures, and production halts for high-emission industries like steel, chemicals, and textiles.

To avoid supply chain disruption and potential penalties, companies must remain up to date with the latest policies and compliance requirements.

7. Rare Earth Metals Export Ban

The shortage of rare earth metals poses a critical risk to United States supply chains in 2025. China dominates the production and processing of rare earth minerals essential for high-tech industries like semiconductors, electric vehicles, defense systems, and renewable energy. In fact, the country currently controls more than 60% of global rare earth mining and over 85% of refining capacity.

China has weaponized the export of these rare earth minerals to the US as part of the ongoing trade war. In December 2024, China’s Ministry of Commerce announced a total ban on the export of gallium, germanium, antimony, and superhard materials and tighter restrictions on dual-use graphite materials in direct response to the US sanctions targeting China’s semiconductor industry. If these embargoes escalate, US supply chains reliant on rare earth minerals could face severe shortages, production delays, and higher costs all around.

To mitigate this risk, the US has made efforts to diversify its supply with domestic mining projects and partnerships with Australia and Canada. It will take years for these initiatives to put a significant dent in our dependence on Chinese exports. In the meantime, companies can protect themselves by exploring alternative sourcing and investing in rare earth recycling. Direct mineral purchasing agreements between companies and mines were a popular method of proactively securing a stable of essential minerals in 2024.

Learn more about the Rare Earth Metals Export Ban on our blog.

8. The Nearshoring Dilemma

Nearshoring in Mexico and Canada was a popular strategy for companies navigating China’s volatile supply chain in the years following the COVID-19 pandemic. The Trump administration’s tariff policies have cast doubt on the future of this trend.

In an effort to combat fentanyl smuggling, illegal immigration, and trade imbalances, President Trump implemented a 25% additional tariff on imports from Canada and Mexico and a 10% additional tariff on imports from China. According to this announcement, energy resources from Canada would only be subjected to a 10% additional tariff. The executive order imposing these new tariffs was set to go into effect on February 4th. Soon after retaliations were announced, the administration met with Mexico and Canada to negotiate and agreed to pause the new tariffs for one month. They will now take effect on March 4th, 2025.

Canada announced a retaliatory 25% tariff against $155 billion worth of US goods, including immediate tariffs on $30 billion worth of goods as of March 4th and $125 billion worth of American products in 21 days. Affected items include alcohol, produce, clothing, shoes, household appliances, furniture, lumber, and much more.

Mexican President Claudia Sheinbaum is hoping to come to a new agreement with President Trump before March 4th but will enact tariffs and non-tariff retaliatory measures if necessary.

According to Jacob Jensen, trade policy analyst at the American Action Forum, the US public will face a total tax increase between $120 billion and $225 billion annually if the 25% tariffs take effect.

Rising material costs could undermine the cost advantage that attracted companies to Mexico and Canada in the first place. Companies that re-shore production to the United States may still rely on cross-border trade with Mexico for components and raw materials. Consequently, some companies are considering relocating to a more tariff-friendly environment in Central or South America to maintain cost-effectiveness. Ultimately, if these tariffs do take effect, the nearshoring trend may lose momentum and push companies to seek more creative workarounds.

How to Monitor and Mitigate China’s Supply Chain Issues in 2025

The SCRMC advocates strongly for digitizing the supply chain. This enables modeling the supply chain to run “What-if” risk event scenarios that show how a supply chain will respond before the risk event occurs. Scenarios render risk assessments using techniques like Risk-Priority-Numbering and Value-at-Risk calculations.

According to SCRMC founder Greg Schlegel, “When supply chain modeling tools like Cosmic Frog are exercised, every scenario displays the financial impact of a risk event and potentially a risk assessment. Companies can use this data to develop risk mitigation plans. The SCRM Consortium calls this “Stress-Testing the Supply Chain” and deems it an SCRM exemplary company best practice.”

The SCRM Consortium has also advocated the use of FM Globals’s Risk and Resilience Country Index. They rate 130 countries and rank their risk and resiliency every six months. The rank is based on three major sectors driven by 15 critical infrastructure indicators and includes an evaluation of the country’s supply chain infrastructure.

Because China is so large, the Index has segmented the country into three sectors. Here’s how they’re ranked according to 2025 data:

- China Region 1: 101

- China Region 2: 92

- China Region 3: 86

All three of China’s sectors were ranked in the 70s as of 2022. A high rank means low resiliency and increased risk.

Currently, Mexico is ranked 76, Canada’s three regions are ranked 29, 25, and 20, and the United States’ three regions are ranked 12, 17, and 10 respectively.

Four Ways to Mitigate China Supply Chain Risk

1. Diversification

Diversify your supplier base by sourcing materials and products from multiple suppliers. Further reduce dependency and lessen the impact of potential disruptions by spreading the suppliers across multiple regions or countries.

2. Risk Assessment

Conduct a comprehensive risk assessment to proactively identify and address potential disruptions using Cosmic Frog.

3. Collaboration

Collaborating with suppliers and other stakeholders to create contingency plans that reduce the negative impact of predicted disruptions.

4. Redundancy

Incorporate redundancy by keeping safety stock, identifying alternate transportation routes, and establishing backup suppliers.

How to Quantify China Supply Chain Risk in Global Decisions

To build a resilient supply chain, it’s essential to identify risks in your network, understand potential disruptions, and create effective mitigation scenarios. Cosmic Frog is the ideal platform for evaluating China sourcing and production, allowing you to balance trade-offs across cost, service, and risk.

Model Your China Exit Strategy Using Cosmic Frog

This model tackles the critical question: Should we reduce dependence on China, and if so, how can we maintain production within Asia while mitigating risks?

Why Cosmic Frog?

Cosmic Frog is the only SaaS-based supply chain design platform that combines optimization, simulation, and risk analysis across the entire end-to-end supply chain.

By leveraging this technology, you can evaluate strategic changes with digital models, testing the performance of multiple scenarios. Cosmic Frog empowers you to make informed decisions beyond cost; you’ll analyze trade-offs across financial, service, risk, and sustainability metrics.

With its unique capabilities, Cosmic Frog helps identify risks and simulate solutions, enabling side-by-side comparisons for smarter, more resilient supply chain strategies.