Blog

Trends in the Automotive Industry in 2024

PUBLISHED ON:

January 13, 2024

Subscribe to Receive the Latest Supply Chain Design Resources

With 2023 in our rear-view mirror, automotive OEMs and their suppliers were faced with another major disruption when the United Auto Workers (UAW) decided to strike for 6 ½ weeks to improve compensation for its workers.

This disruption is estimated to have cost the automotive industry $9.3 billion with the UAW targeting shutdowns of the highest profit-generating plants for the Big Three (GM, Ford & Stellantis Chrysler).

Automotive Giant Uses Supply Chain Design to Minimize Effects of Disruption

One of these automakers had a competitive advantage: a supply chain design Center of Excellence (COE) to minimize the financial and service level impacts of the disruption on the aftermarket parts side of the business.

This automaker could quickly identify alternative distribution centers (DCs) with existing labor and capacity to meet their customer demand and expected service levels required to keep their automotive dealerships up and running. This was all made possible by having the ability to test and analyze future supply chain states and then simulate fluctuating demand and new inventory strategies against all the optimal DC options provided to select the best fit.

This automaker estimates savings in the tens of millions, and kept new and existing customers happy and satisfied during this disruption.

Shifts in Consumer Demand for Automobiles

During the UAW strikes another shift in the automotive market started to occur. Your local car dealerships lots were filling up with new and used car inventory followed by plenty of advertising with incentives to purchase a new car during the holiday season. Both of the events were relatively rare since the pandemic.

There are multiple factors causing this shift, including:

- High interest rates

- Influx of car purchases during the pandemic

- Automakers anticipating shutdowns and increased capacity prior to pandemic

- Potential new customers holding onto their cars longer due to inflated MSRP

With this new shift in customer demand and increased inventory levels come new challenges and questions for our aforementioned automaker. By leveraging their manufacturing production supply chain design model, they can now focus on how to flush out optimal sourcing options, future capacity constraints, include seasonality and update multi-echelon inventory strategies to prepare for what’s next.

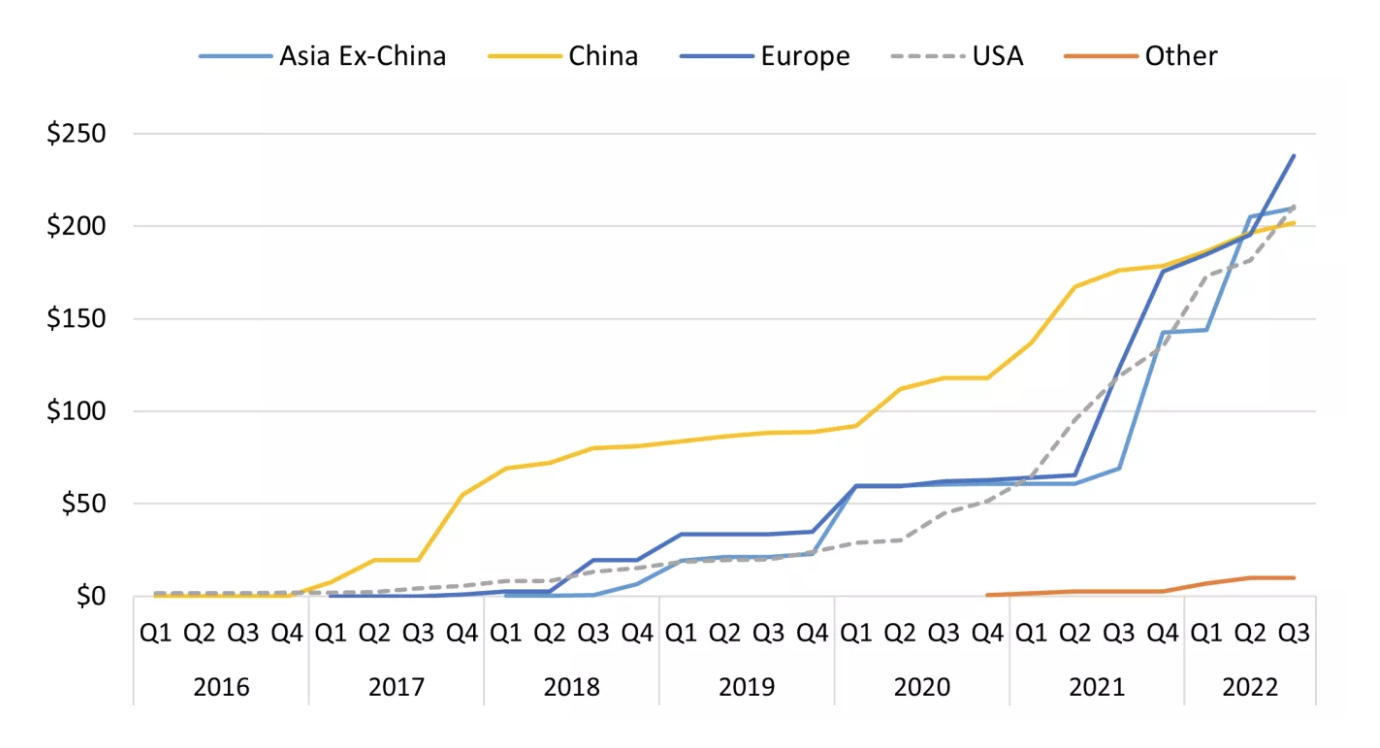

Automotive Chip Sourcing

Post-COVID, automotive manufacturers are focused on supply chain resiliency. The industry is exploring pathways to avoid the shutdowns that resulted from disrupted supply chains triggered by the pandemic.

Sourcing parts presents significant challenges for the industry, especially as China supply chain issues continue to increase. As the nation continues to pose a threat to Taiwan –– the primary provider of automotive chips to the U.S. –– OEMs must find alternate sources for these vital parts.

As manufacturers reflect on the results of chip shortages, Tier 1 suppliers and OEMs are considering sourcing and how various factors will affect the supply chain and the need for its redesign.

EV Adoption

Across the automotive industry, many OEMs are strategically adopting electric vehicle production. This shift has created a massive and virtually overnight need for battery tech and suppliers.

In the past, much of the U.S.’s battery need was sourced out of Mexico, which caused significant supply chain issues. On the road, supply trucks created bottlenecks traveling from Mexico into Texas across the border. If OEMs try to avoid transportation bottlenecks, they opt for rail transport, but these avenues are at capacity. And if the U.S. government closes borders or limits access into the country, the supply is disrupted, affecting the entire industry.

Outsourcing battery needs or EV parts to Mexico results in delivery disruptions regardless of your chosen transportation route. Companies must analyze sourcing risks and identify alternatives within the lower 48 states. By solving for supply chain design, the automotive industry can determine risk factors and make data-driven decisions to optimize its supply sourcing for the emerging EV market.

Optilogic solutions help identify sourcing risks through greenfield analysis, helping you understand your baseline network. You can remove constraints to determine your optimal network then layer in additional constraints, running simulations to create an optimal supply chain design.

In addition to basic constraints and risk factors, Optilogic provides data for variables you don’t typically consider: the war in Ukraine, the energy crisis in Europe, and other factors affecting suppliers and your supply chain.

For EV manufacturers to access the parts they need on their timeline, they must consider supply chain risk analysis and use that data to create smart supply chain design that prepares them for today and the future of EV production.

Alternative Sourcing and Decentralization

“Where is my alternate sourcing, and where is my risk?” These are the primary questions for the automotive industry today.

Bottom line: you must hit your service targets. If risks affect your supply chain and result in a shutdown, every piece of manufacturing and delivery is affected. When you shut down a production line in the automotive industry, you lose, on average, $22,000 per minute. That quickly adds up. Overall, unplanned downtime costs industrial manufacturers as much as $50 billion a year.

Previously, Tier 1 vendors placed locations near assembly plans to show partnership and reduce these risks. But as labor costs in the U.S. increased, that work was outsourced to more affordable areas like Mexico and China. As a result, risks––and supply chain disruptions––increased.

International sourcing presents myriad issues for the automotive industry. Border issues are never-ending and constantly shifting. Chinese products are affected explicitly by the Uyghur Forced Labor Prevention Act. If the supplier country is under the Act, those products are held up at ports, disrupting supply chains and losing money each moment those goods are stuck.

With the risk potential associated with importing automotive parts, the conversation is focused on decentralization: how can companies bring production back to the US in local contexts? The immediate costs of labor or property leases might increase, but the long-term cost reduction is invaluable. When producing vehicles and chips domestically, we can sell vehicles instead of tagging and parking them on lots while we wait for the right products to come in from overseas suppliers.

Mergers and Acquisitions

Merging and acquisition have been topics of interest for a decade or more where the automotive supply chain is concerned. OEMs desire integration, streamlining their processes and integrating with parts manufacturers.

Optilogic has found that, on average, Tier 1 suppliers execute two to three acquisitions per year. These acquisitions have pros and cons. There are now fewer vendors to source from, reducing options from a cost and quality issue standpoint. But when you merge and acquire companies, you expand your sourcing capability.

Now you must determine the most effective way to fit this into your supply chain, and Optilogic helps you get there.

Though industry leaders have been having this conversation for ten years or more, only recently have companies taken advantage of supply chain solutions to optimize mergers and acquisitions with data-driven decisions.

Supply Chain Design for the Automotive Industry

Imagine this scenario: your budget has been reduced; you must maintain the same output, but you must do it at a higher level and more efficiently; and you have a service level target you must meet.

Every executive understands this hypothetical because it’s the reality for the automotive industry. You must hit your bottom line, and you need solutions to identify hidden costs to optimize your resource spend.

The Optilogic Cosmic Frog supply chain design platform helps you understand where you can streamline and optimize your supply chain to accomplish more with less. Cosmic Frog allows you to optimize according to various factors and goals:

1. Cost

Design a supply chain that meets demand while maintaining desired profit margins.

2. Ethically Sourced Inputs and Labor

Build a supply chain centering ethical practices. Optilogic designs supply chains by including certain constraints within the platform to meet ethics standards.

3. Risk Rating

Cosmic Frog is the only supply chain design solution that offers supply chain risk engine and analysis. There are risks associated with business decisions such as sourcing and inventory policies, and external, systemic risks which might vary based on the network’s structure. Supply chains are susceptible to events such as natural disasters, import and export policies, and local labor markets, to name a few. Cosmic Frog’s risk rating engine considers these factors in its identification and quantification of the risk of each scenario.

Supply chain risk management and resiliency are significant trends within the automotive industry. And whether you’re aware of risks or not, they exist and can disrupt any part of your operation’s supply chain.

Today’s automotive supply chains need to be tougher than ever to withstand the risk inherent in today’s political, environmental, and economic climate. If you aren’t considering cost, service, and risk in the supply chain design phase, your supply chain is not engineered for resilience.

Optilogic Cosmic Frog is the only supply chain design platform that balances financials, service, and risk—in a 100% SaaS-based environment.

Ready to get started? Create your free trial account and contact us for help along the way.

Grow Your Knowledge

7 Expert Tips for Building a Sustainable Supply Chain Design Organization

A successful, profitable, sustainable supply chain starts within your organization. Developing internal competency for supply chain design and network optimization capabilities is at the core of not only supply chain success but also the success of your entire company. At the OptiCon 2024 event, Kerry Rosenhagen, managing director at NTT Data Supply Chain Consulting co-led a session explaining the foundations of effective supply chain design.