Blog

Trends the Consumer Goods Industry Faces in 2024

PUBLISHED ON:

March 30, 2023

Subscribe to Receive the Latest Supply Chain Design Resources

The consumer goods industry changes fast. Every month, week, and even day can bring new consumer behaviors significantly affecting the market and how CPGs operate.

For CPG companies to adapt and thrive, leadership must understand and move with industry trends. This article from Optilogic explores trends the CPG industry faces in 2023 and how companies can evolve to meet new consumer demands.

The Emergence of the Digital World

As the digital shelf expands, CPG companies must understand how digital trends will affect consumer behavior and, as a result, their practices and processes.

Below we explore how the emergence of the digital world, specifically social media and e-commerce, shape the CPG industry.

1. Social Media Pushing Trends in Consumer Behavior

Consumers live in the age of social media. And whether they’re aware or not, social media and influencers shape their purchase decisions.

Social media celebrities with expansive platforms and global reach push products and shape consumer buying habits. Social media trends come on quickly, forcing the CPG industry to react at lightning speed.

Manufacturers are forced to react quickly when social media affects Sales and Operations Planning (S&OP) processes and timelines. Overnight, new products go viral, and consumer demand skyrockets. The problem is that CPG, by design, cannot react at the speed of social trends. CPG can’t keep up, and these trends push margins through the floor.

The industry must implement agility in its operations to meet customer demand while maintaining sustainable, profitable practices.

2. E-Commerce

Thanks to Amazon, consumers expect to buy a product online and have it delivered the next day. But what does that mean for CPGs?

Traditional CPG supply chains included four entities: the supplier, the manufacturer, the warehouse, and the store. Thanks to the present consumer demand for near-instant delivery and expectations of unfettered access to products and goods, CPG companies must restructure their supply chains to evolve and meet these expectations.

E-Commerce shopping and purchasing habits force CPG companies to consider how to most effectively and efficiently create supply networks to meet customer demand while maintaining profits.

E-commerce sales in the 3rd quarter of 2023 increased 7.6 percent over 2022 figures.

Census Bureau

As a result, CPG companies are morphing into distribution companies. This shift forces their model to evolve into a supplier-factory-to-warehouse-to-customer chain. Many companies are building transportation fleets, especially now with small delivery fleets serving as extensions of their retail arm, forcing them into the transportation space.

However, many companies struggle to maintain these new chains. CPG systems aren’t built to include DTC (direct-to-consumer) solutions in their supply chains. These implementations are expensive, and many CPGs don’t have the resources or infrastructure to sustain these models long-term.

Social media and online influence force a faster reaction time in the CPG industry. Faster times cause them to model their supply chain differently, resulting in increasingly transportation-based models instead of brick-and-mortar or stocking-with-store methods. As a result, their supply must be more spread out and closer to the consumer to meet customer delivery demands.

CPGs need effective supply chain solutions to meet consumer expectations for DTC services in an increasingly digital space.

[Guide] Start Considering Risk in Your Supply Chain Design with these 4 Steps

Unlock Your Free Guide

Consumer Products and Data Usage

Data plays a significant role in CPG. CPG companies are now application-based and have the technology to predict consumer trends or use advertising and marketing for demand shaping. They’re using machine learning and AI to track customer behavior to ensure they have the correct supply to meet the demand.

Traditionally that demand would be mapped by geolocation and go through the old S&OP processes. Now, customers can set up their stores so brands can track where customers shop, the items they look at, customer interests, and items left in their carts. Companies then map out that data from a demand and supply perspective.

CPG is becoming a predictive supplier, leveraging technology to predict trends based on consumer data. Based on this data, CPGs can know

- What to produce

- When to produce it

- Product volume

- Where a consumer wants the product (store location or delivery)

Consumer data takes the guesswork out of CPG manufacturing and distribution, creating streamlined processes, reducing waste, and ultimately getting the right products in the consumers’ hands when they want them.

Personalization within CPG

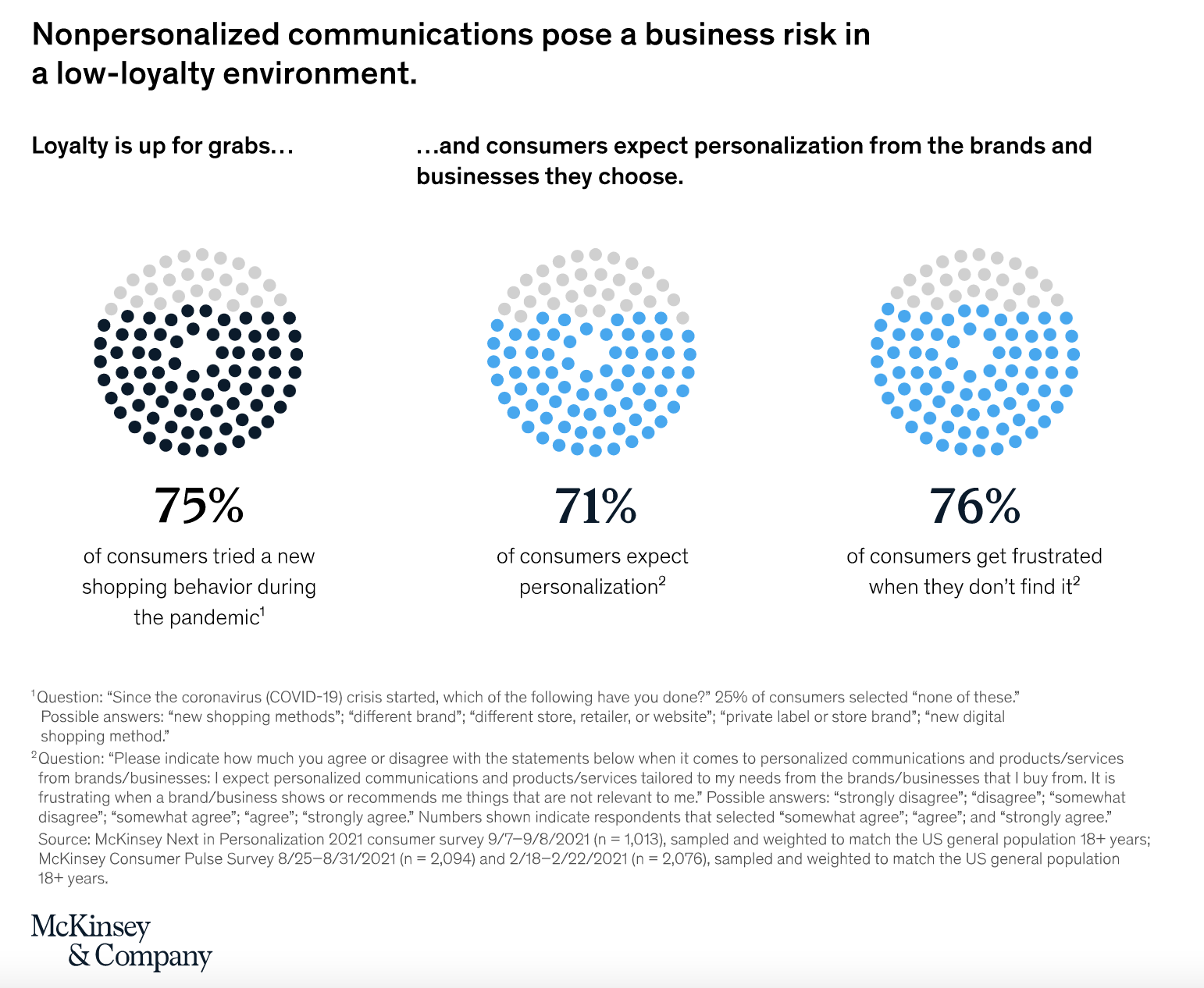

Consumers expect personalization in every digital interaction with a company or brand. They want products created to meet their unique needs. As a result, companies are creating product experiences that are extremely specific and designed to hit niche pain points.

This demand for product personalization is a drain on CPGs. Your company might produce the same product on your lines, but how it’s packaged, transported, and finally stocked on shelves is specific and nuanced to meet personalization requirements.

Each SKU must be forecasted, supplied, branded, and sold. From changing packaging design to seasonality, all personalization and changes at the micro level put considerable stress on CPGs.

The trend in personalization means CPGs are creating more product variations with the same resources. Companies feel the pressure to maintain shelf space, ensure that consumers are coming in to buy the products, and meet supply and demand.

With personalization trending among consumers, CPGs must understand what the shopper is looking for. They must curate, personalize, and deliver, and the CPG supply chain must adapt to these demands.

How Optilogic Can Help

Retail is becoming increasingly digital. Companies have access to endless metadata associated with each consumer. This high volume of data overwhelms CPGs, leaving companies burdened with a load of data that they must organize and analyze before using it. Optilogic harnesses and analyzes data at the product and customer levels to create digital models of the future supply chain to answer your strategic what-if questions including:

- What should we do if demand shifts from one SKU to another?

- What should we do if demand for item A skyrockets and demand for item B plummets?

- What if there’s a catastrophic fire or weather event at a facility? What’s plan B?

- What if a key supplier doesn’t deliver?

Our Cosmic Frog supply chain design solution analyzes consumer need and demand trends, then provides data-driven assessments that inform your supply chain decisions, helping you optimize your networks. From Intelligent Greenfield Analysis to distribution locations and transportation options, we outline every component in your supply chain to ensure you meet your goals and build processes according to your specific requirements.

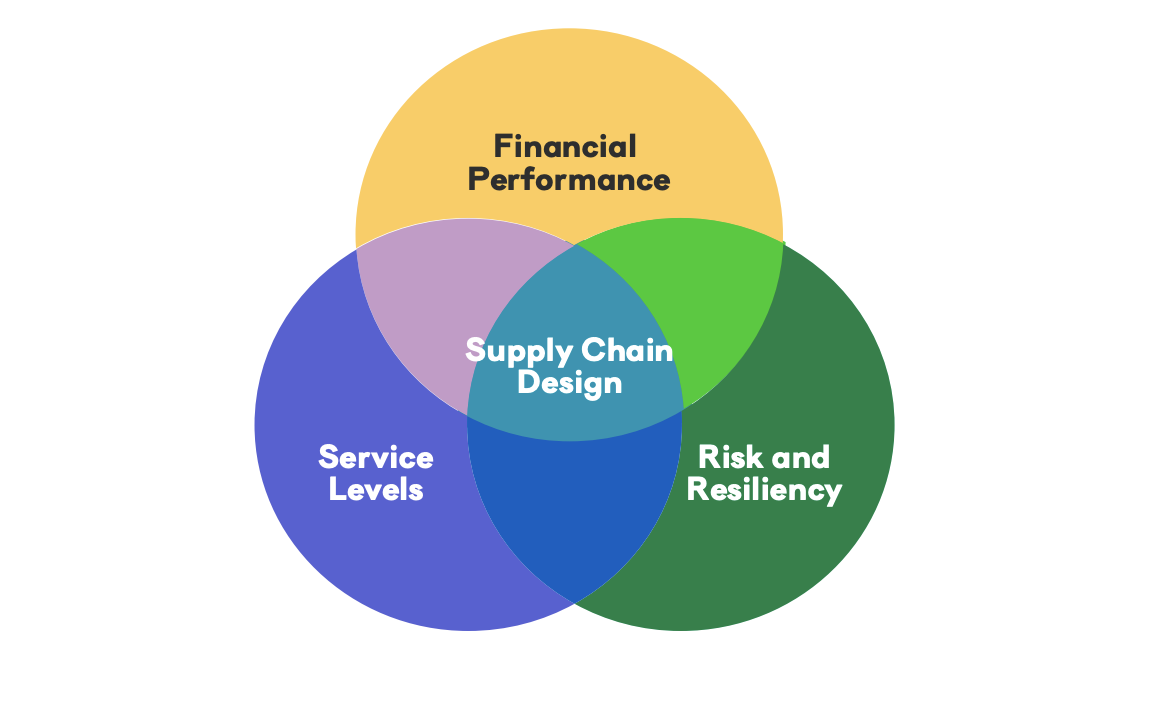

Optilogic supply chain design allows you to optimize according to various factors and goals:

1. Cost

All CPGs are extremely cost focused. We help you design a supply chain that meets customer delivery demand while maintaining desired profit margins.

2. Ethically Sourced Inputs and Labor

How do you build a supply chain around ethical practices regarding vital materials and labor? Optilogic allows you to include certain constraints within the platform to meet ethics standards.

3. Risk Assessment

Optilogic is the only supply chain design solution offering supply chain risk engine and analysis. Our software allows you to run scenarios based on the input variables. With each question you ask of Optilogic, we deliver a risk score. Based on your inputs and the resultant risk scenarios that our model produces, we provide insight that helps you make confident, data-driven decisions.

Design Your CPG Supply Chain for Resiliency by Considering Cost, Service, and Risk

Trends within any industry come and go, but it’s up to you to ensure you’re prepared to adapt to changes in the market. Today’s supply chains need to be tougher than ever to withstand the risk inherent in today’s political, environmental, and economic climate. If you aren’t considering cost, service, and risk in the supply chain design phase, your supply chain is not engineered for resilience.