Published by

Sarah Butler

Published on

February 17, 2025

JTVCYXV0aG9yX2luZm8lNUQ=China’s latest rare earth metals export ban is a pivotal escalation in the festering United States-China trade war. By cutting off the export of these four rare minerals, China has directly targeted the backbone of advanced technology production in the US. This strategic retaliation will bring far-reaching implications for global supply chains, advanced technology production, and geopolitical dynamics. China has shown it is willing to publicly and directly confront the US as a foreign trading partner. Below, we’ll outline how we arrived at this critical juncture, the key impacts on industries reliant on these resources, and steps supply chains can take to adapt in 2025 and beyond.

On December 3, 2024, China’s Ministry of Commerce announced an immediate halt to the export of gallium, germanium, antimony, and superhard materials to the US, citing their dual military and civilian applications. Additionally, stricter reviews were imposed on the export of graphite. These rare earths are integral to the production of semiconductors, electronics, weaponry, solar technologies, electric vehicles, and more. Key Points About the Ban:

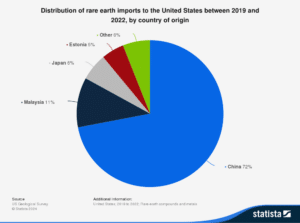

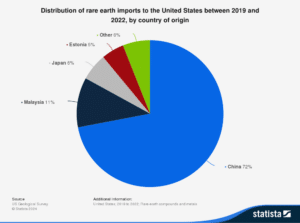

China’s dominance in rare earth mineral production is substantial:

This heavy reliance on China creates vulnerabilities for US industries, as domestic extraction and processing remain costly and challenging. These bans are expected to deepen supply shortages in critical areas. Emerging Challenges:

Source: US Geological Survey Statista 2024

Ever since the Trump administration first announced restrictions targeting Chinese technology back in 2019, tensions have been on the rise. Even with the consistent expansion of sanctions and export controls targeting Chinese tech, the country has made strides as an industrial superpower over the last eight years. China’s manufacturing sector is now larger than that of the US, Germany, Japan, South Korea, and the UK combined. They are now close to ending dependence on US supplies in many sectors, save for the fastest semiconductors.

Banning the export of critical rare earth minerals to the US is China’s direct retaliation against US tariffs and sanctions on Chinese technology. This is the latest development in the tit-for-tat trade war between the US and China that we’ve watched unravel since the Trump administration began setting punitive tariffs and restricting China’s access to US technology back in 2018. The Biden administration furthered these policies by strengthening anti-China alliances and escalating sanctions. The rare earth mineral ban was China’s immediate response to the administration’s third crackdown on China’s semiconductor industry in three years, announced on December 2, 2024. The restrictions curb exports to 140 Chinese companies, targeting shipments of advanced memory chips and chipmaking equipment from the US to China. The goal was to keep China from accessing and producing chips for artificial intelligence and military applications. China responded by banning the export of four minerals critical to the production of semiconductors and advanced weaponry. That same day, four government-linked trade associations urged Chinese companies to be wary of purchasing US-made computer chips. This retaliation could also be a pre-emptive measure against the 10% tariffs on Chinese goods and 60% tariffs on Chinese imports threatened by the incoming Trump administration. Timeline of Key Events:

China’s current export ban directly targets restrictions placed on its semiconductor industry, which the Biden administration expanded in December 2024. The policy prohibits exports to 140 Chinese entities and aims to curb China’s technological advancements in AI and defense. The Risks: The ongoing tit-for-tat measures have isolated American firms, increased supply chain fragmentation, and heightened concerns about economic and defense security.

Defense technologies in the US rely on these rare minerals, making shortages a risk to maintaining parity with China's military advancements. China is significantly outpacing the US in developing advanced weaponry and munitions.

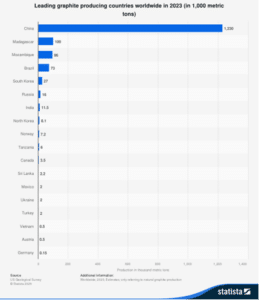

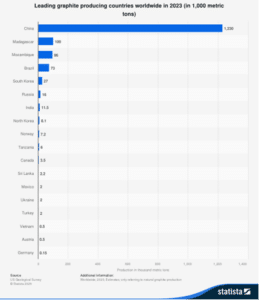

A recent US Geological Survey report estimated that a total gallium and germanium export ban could result in a $3.4 billion GDP loss for the US economy. And while graphite exports haven’t been banned completely, the ever-tightening restrictions also pose a significant threat. Less than 1% of the world’s graphite reserves are located in the US, making the country fully reliant on imports. China, on the other hand, holds 15.8% of the world’s graphite and is responsible for 77% of natural graphite, over 95% of synthetic graphite production, and almost 100% of graphite refining. Seeing as the average electric vehicle requires 136 pounds of graphite and the EV industry is expected to generate 99,600 jobs as a result of the Inflation Reduction Act, a total ban on graphite would be detrimental to the EV industry and the US economy as a whole

By warning against the purchase of American chips, China also threatens the reputation of the US chip industry. This could have bad financial implications for chip manufacturers. On the day the rare mineral export ban was announced, the China Semiconductor Industry Association went so far as to warn Chinese companies by saying “American chip products are no longer safe and reliable, and related Chinese industries will have to be cautious in purchasing American chips.”

China’s export restrictions seek to redirect supply chains away from US markets:

Companies across industries are taking proactive measures to mitigate the fallout of China’s export ban:

Pro Tip: To mitigate risk, focus on supplier diversification and scalable recycling programs that can recover materials from end-of-life electronics.

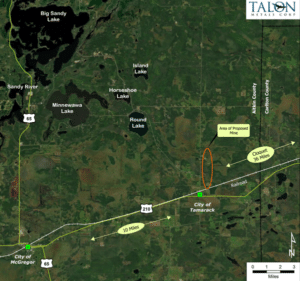

According to a White House spokesperson, the US is assessing the new restrictions and will take the necessary steps in response. “These new controls only underscore the importance of strengthening our efforts with other countries to de-risk and diversify critical supply chains away from PRC (China)," the spokesperson said. The US will likely need to use incentives and financing instruments to secure new rare earth mineral sources. For example, in 2024 the US International Development Finance Corporation issued a loan of $150 million to a graphite mining project in Mozambique. Together, Mozambique, Madagascar, and Tanzania have 21% of the world’s graphite, whereas China holds 15.8%.

While this is the first time China has announced a targeted rare earth mineral ban. One previous embargo was in response to an event in September of 2010. A Chinese fishing boat collided with two Japanese coastguard vessels and the Chinese fishing boat captain was arrested. China responded to the arrest by halting the export of rare earth minerals to Japan. The embargo was carried out suddenly, in complete secrecy. Rather than publishing an official announcement, China's Commerce Ministry called in representatives of two dozen rare earth mineral companies and told them not to export rare earth minerals to Japan. These companies were warned that they could lose their export licenses if they leaked these instructions to the media. This sudden, unannounced ban sparked international concern about China's dominance in the rare earth industry. Supply chains impacted by today’s export bans can draw some valuable lessons from Japan’s response. At the time, the country depended on China for nearly 90% of rare earth mineral imports. In response to their alarming vulnerability, the Japanese government created a package of comprehensive measures with a supplemental budget of JPY100 billion to bolster the resilience of its rare earth mineral supply chain. The package had five pillars:

Using this plan, Japan dealt with the embargo by increasing investment in alternative sources, ramping up recycling programs, and researching alternatives to reduce its mineral usage. They formed partnerships with countries and companies to diversify their supply of rare earth elements. One of their most effective diversification moves was helping the Australian company Lynas develop a large, rare earth metals mine. Japan’s dependence on China is now down from 90% to 60% as a result of these efforts.

China dominates the world’s supply of rare earth minerals to this day. Supply chains reliant on rare earth mineral exports should be prepared for similar sudden, unannounced supply interruptions. Now is the time to analyze vulnerabilities within your supply chain and form a plan to diversify. As they work toward reducing reliance on China’s rare earth minerals, US supply chain managers can use Japan's response plan as a strategic guide.

The trade war between the US and China will likely continue to escalate throughout 2025. In the face of further Chinese export restrictions on rare earth minerals, here are some ways supply chains in impacted industries can strategically adapt and mitigate disruptions:

China’s rare earth metals export ban is more than a tactical response to escalating US sanctions—it’s a strategic maneuver that will reshape global supply chains and test the resilience of industries dependent on these critical resources. The ban highlights an urgent need for diversification, investment in domestic capabilities, and innovative approaches like recycling rare earth elements. The trade war will likely escalate throughout the year. Now is the time for supply chains dependent on China’s rare earth elements to prioritize preparing for future disruptions. Start strategizing today to secure your supply chain’s future. For advanced modeling solutions, visit Cosmic Frog and build next-generation supply chain frameworks with confidence.

JTVCYXV0aG9yX2luZm8lNUQ=China’s latest rare earth metals export ban is a pivotal escalation in the festering United States-China trade war. By cutting off the export of these four rare minerals, China has directly targeted the backbone of advanced technology production in the US. This strategic retaliation will bring far-reaching implications for global supply chains, advanced technology production, and geopolitical dynamics. China has shown it is willing to publicly and directly confront the US as a foreign trading partner. Below, we’ll outline how we arrived at this critical juncture, the key impacts on industries reliant on these resources, and steps supply chains can take to adapt in 2025 and beyond.

On December 3, 2024, China’s Ministry of Commerce announced an immediate halt to the export of gallium, germanium, antimony, and superhard materials to the US, citing their dual military and civilian applications. Additionally, stricter reviews were imposed on the export of graphite. These rare earths are integral to the production of semiconductors, electronics, weaponry, solar technologies, electric vehicles, and more. Key Points About the Ban:

China’s dominance in rare earth mineral production is substantial:

This heavy reliance on China creates vulnerabilities for US industries, as domestic extraction and processing remain costly and challenging. These bans are expected to deepen supply shortages in critical areas. Emerging Challenges:

Source: US Geological Survey Statista 2024

Ever since the Trump administration first announced restrictions targeting Chinese technology back in 2019, tensions have been on the rise. Even with the consistent expansion of sanctions and export controls targeting Chinese tech, the country has made strides as an industrial superpower over the last eight years. China’s manufacturing sector is now larger than that of the US, Germany, Japan, South Korea, and the UK combined. They are now close to ending dependence on US supplies in many sectors, save for the fastest semiconductors.

Banning the export of critical rare earth minerals to the US is China’s direct retaliation against US tariffs and sanctions on Chinese technology. This is the latest development in the tit-for-tat trade war between the US and China that we’ve watched unravel since the Trump administration began setting punitive tariffs and restricting China’s access to US technology back in 2018. The Biden administration furthered these policies by strengthening anti-China alliances and escalating sanctions. The rare earth mineral ban was China’s immediate response to the administration’s third crackdown on China’s semiconductor industry in three years, announced on December 2, 2024. The restrictions curb exports to 140 Chinese companies, targeting shipments of advanced memory chips and chipmaking equipment from the US to China. The goal was to keep China from accessing and producing chips for artificial intelligence and military applications. China responded by banning the export of four minerals critical to the production of semiconductors and advanced weaponry. That same day, four government-linked trade associations urged Chinese companies to be wary of purchasing US-made computer chips. This retaliation could also be a pre-emptive measure against the 10% tariffs on Chinese goods and 60% tariffs on Chinese imports threatened by the incoming Trump administration. Timeline of Key Events:

China’s current export ban directly targets restrictions placed on its semiconductor industry, which the Biden administration expanded in December 2024. The policy prohibits exports to 140 Chinese entities and aims to curb China’s technological advancements in AI and defense. The Risks: The ongoing tit-for-tat measures have isolated American firms, increased supply chain fragmentation, and heightened concerns about economic and defense security.

Defense technologies in the US rely on these rare minerals, making shortages a risk to maintaining parity with China's military advancements. China is significantly outpacing the US in developing advanced weaponry and munitions.

A recent US Geological Survey report estimated that a total gallium and germanium export ban could result in a $3.4 billion GDP loss for the US economy. And while graphite exports haven’t been banned completely, the ever-tightening restrictions also pose a significant threat. Less than 1% of the world’s graphite reserves are located in the US, making the country fully reliant on imports. China, on the other hand, holds 15.8% of the world’s graphite and is responsible for 77% of natural graphite, over 95% of synthetic graphite production, and almost 100% of graphite refining. Seeing as the average electric vehicle requires 136 pounds of graphite and the EV industry is expected to generate 99,600 jobs as a result of the Inflation Reduction Act, a total ban on graphite would be detrimental to the EV industry and the US economy as a whole

By warning against the purchase of American chips, China also threatens the reputation of the US chip industry. This could have bad financial implications for chip manufacturers. On the day the rare mineral export ban was announced, the China Semiconductor Industry Association went so far as to warn Chinese companies by saying “American chip products are no longer safe and reliable, and related Chinese industries will have to be cautious in purchasing American chips.”

China’s export restrictions seek to redirect supply chains away from US markets:

Companies across industries are taking proactive measures to mitigate the fallout of China’s export ban:

Pro Tip: To mitigate risk, focus on supplier diversification and scalable recycling programs that can recover materials from end-of-life electronics.

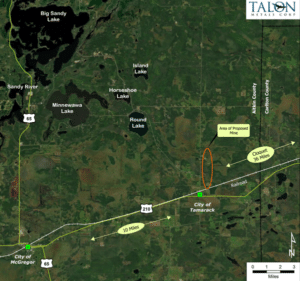

According to a White House spokesperson, the US is assessing the new restrictions and will take the necessary steps in response. “These new controls only underscore the importance of strengthening our efforts with other countries to de-risk and diversify critical supply chains away from PRC (China)," the spokesperson said. The US will likely need to use incentives and financing instruments to secure new rare earth mineral sources. For example, in 2024 the US International Development Finance Corporation issued a loan of $150 million to a graphite mining project in Mozambique. Together, Mozambique, Madagascar, and Tanzania have 21% of the world’s graphite, whereas China holds 15.8%.

While this is the first time China has announced a targeted rare earth mineral ban. One previous embargo was in response to an event in September of 2010. A Chinese fishing boat collided with two Japanese coastguard vessels and the Chinese fishing boat captain was arrested. China responded to the arrest by halting the export of rare earth minerals to Japan. The embargo was carried out suddenly, in complete secrecy. Rather than publishing an official announcement, China's Commerce Ministry called in representatives of two dozen rare earth mineral companies and told them not to export rare earth minerals to Japan. These companies were warned that they could lose their export licenses if they leaked these instructions to the media. This sudden, unannounced ban sparked international concern about China's dominance in the rare earth industry. Supply chains impacted by today’s export bans can draw some valuable lessons from Japan’s response. At the time, the country depended on China for nearly 90% of rare earth mineral imports. In response to their alarming vulnerability, the Japanese government created a package of comprehensive measures with a supplemental budget of JPY100 billion to bolster the resilience of its rare earth mineral supply chain. The package had five pillars:

Using this plan, Japan dealt with the embargo by increasing investment in alternative sources, ramping up recycling programs, and researching alternatives to reduce its mineral usage. They formed partnerships with countries and companies to diversify their supply of rare earth elements. One of their most effective diversification moves was helping the Australian company Lynas develop a large, rare earth metals mine. Japan’s dependence on China is now down from 90% to 60% as a result of these efforts.

China dominates the world’s supply of rare earth minerals to this day. Supply chains reliant on rare earth mineral exports should be prepared for similar sudden, unannounced supply interruptions. Now is the time to analyze vulnerabilities within your supply chain and form a plan to diversify. As they work toward reducing reliance on China’s rare earth minerals, US supply chain managers can use Japan's response plan as a strategic guide.

The trade war between the US and China will likely continue to escalate throughout 2025. In the face of further Chinese export restrictions on rare earth minerals, here are some ways supply chains in impacted industries can strategically adapt and mitigate disruptions:

China’s rare earth metals export ban is more than a tactical response to escalating US sanctions—it’s a strategic maneuver that will reshape global supply chains and test the resilience of industries dependent on these critical resources. The ban highlights an urgent need for diversification, investment in domestic capabilities, and innovative approaches like recycling rare earth elements. The trade war will likely escalate throughout the year. Now is the time for supply chains dependent on China’s rare earth elements to prioritize preparing for future disruptions. Start strategizing today to secure your supply chain’s future. For advanced modeling solutions, visit Cosmic Frog and build next-generation supply chain frameworks with confidence.

Fill out the form to unlock the full content